Goheen Insurance: Securing Legacies with Expertise and Integrity.

September 13, 2021

Estate Planning

The timing of when you begin withdrawing money from your investments can dramatically impact your long-term wealth.

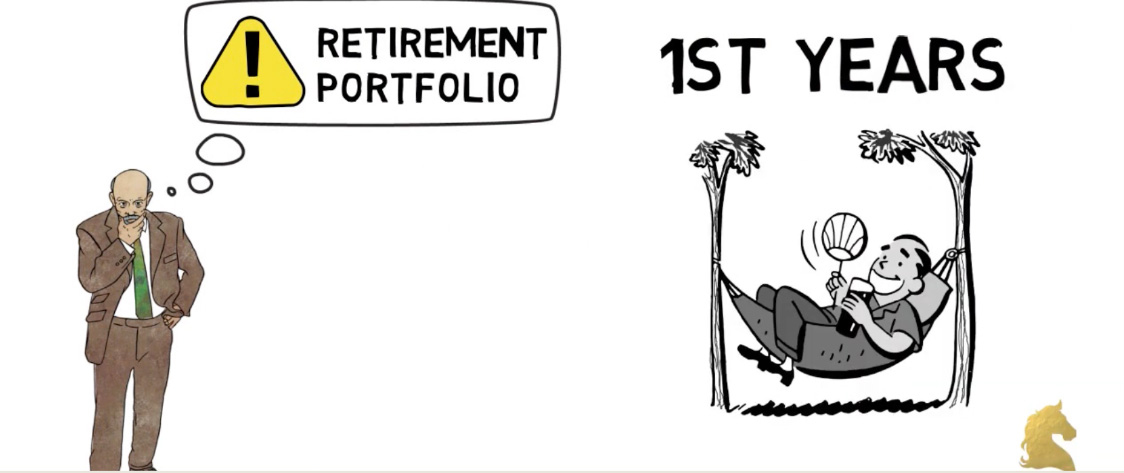

Did you know that one of the greatest risks to your retirement portfolio can happen in the first years you retire? The timing of when you begin withdrawing money from your investments can dramatically impact your long-term wealth.

It’s called sequence-of-return risk, and the danger is very real. When you make regular withdrawals from investments while market returns are down, your portfolio shrinks faster because the investments are worth less. If that happens early in retirement, it’s more difficult to rebuild your assets and get back on track – you could even deplete your portfolio before the good returns show up.

But there are ways to protect yourself from negative returns in the early years of your retirement, including reducing risk in your portfolio and modifying spending in down market years.

For more information on how to achieve a successful retirement, call us today.

Post Tags :

estate planning, Life Insurance, Premium Finance, The Simplicity Company, Tips, Wealth Management

SHAWN GOHEEN

Meet Shawn Goheen, the heart and soul behind Goheen Insurance. Since the early ’90s, Shawn has been more than just a financial advisor; he has been a trusted confidant to high-net-worth individuals. His journey has led him to build strong connections with over 15 specialty lenders and insurance carriers, and relationships with 20+ banks, giving him a rare edge in navigating the often-complex financial world with ease and transparency.

We would love to speak with you personally about any of our services. Contact us today for a free consultation or to learn more!

Still have questions?

We would love to speak with you personally about any of our services. Contact us today for a free consultation or to learn more!

Complete the form above, and a Goheen representative will be in touch within 24 hours with next steps.

At Goheen Insurance, we’re more than just a provider of high-net-worth insurance solutions; we are your partner in securing a financial legacy.

Main

Contact Us

Let’s Figure Next Steps.

© Copyright Goheen Insurance 2024. All Rights Reserved.