3 Strategies To Reduce Your Tax Burden Using Premium Financed Life Insurance

Save for retirement and provide for your heirs with the right life insurance plan

What is Premium Financed Life Insurance, and Should You Take Advantage?

Continue to build wealth and secure your future with premium financed life insurance

How Can You Plan for Long-Term Care?

Statistics say there is a 70% chance that you or your spouse will experience a need for long-term care, but most people wait too long before applying.

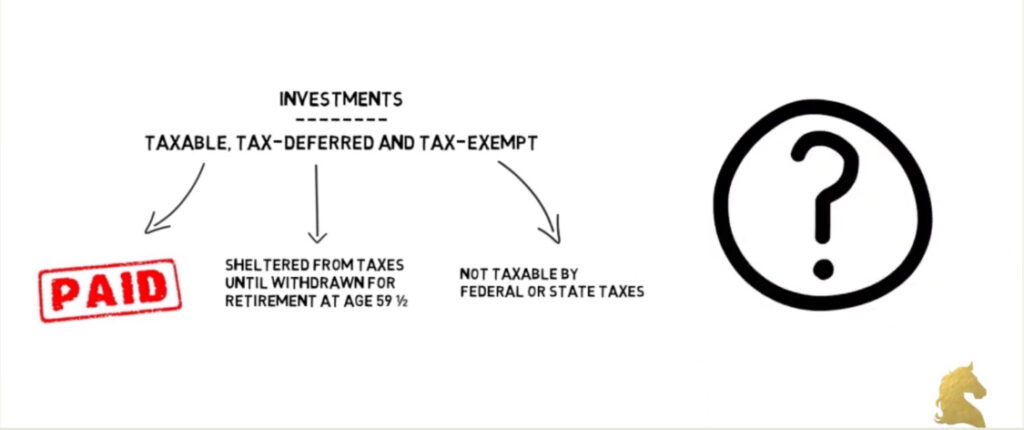

How to Be Tax Efficient With Your Investments

Tax efficient investing involves strategies to help reduce the impact of taxes. Investments have three tax flavors: taxable, tax-deferred and tax-exempt.

How Life Insurance Can Make Your Retirement Tax Free

Many people don’t know that Life Insurance can provide a wonderful vehicle for a tax-free retirement.

3 Questions to Consider When Choosing a Life Insurance Policy

If you’re not sure where to start with choosing a life insurance policy — or if you’re re-evaluating your current policy and looking to lower your premiums or increase your coverage — consider these three questions to help direct your decision making.

Is Tax Planning Missing in Your Retirement Planning?

Too many retirees believe that they don’t have to do any planning in retirement, but there are hidden traps waiting for the unsuspecting.

Don’t Let Timing Ruin Your Retirement

The timing of when you begin withdrawing money from your investments can dramatically impact your long-term wealth.

What is a Rider and How Does It Help You Save on Insurance?

A rider is a provision in an insurance contract, either life insurance or an annuity, that is purchased separately and provides additional benefits beyond the basic policy. Riders help meet your specific needs.

Estate Planning is not just about Estate Taxes, It’s About a Total Plan

You’ve worked so hard to build your net worth, but it could fall into a sinkhole if you don’t do estate planning.